Let me say this before we talk about what the stock market might be saying. Nobody knows. That's correct. What we have are a bunch of market participants, pundits and news organizations trying to use experience and precedent to lay out a scenario they believe is possible in the coming months. Remember this though whenever you hear or see something. It's all a guess or a wish. The reason I say it's possibly a wish is because some investors need the markets to go in a certain direction. If for example you missed this rally because you were afraid that stocks had much farther to fall, then maybe you want it lower. Conversely if you're long stocks maybe you wish for markets to keep going up. In any event nobody knows what's going to occur because nobody's been here before. Keep that in mind as you read further.

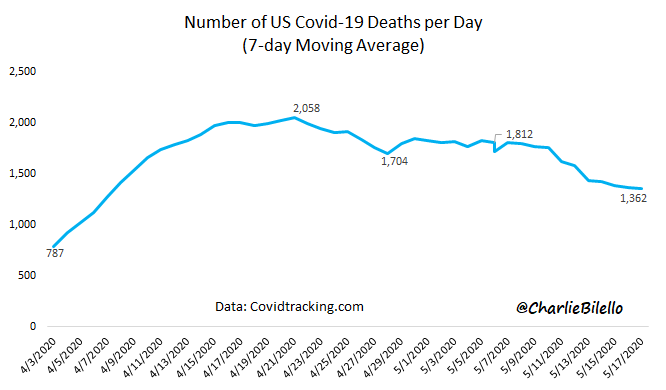

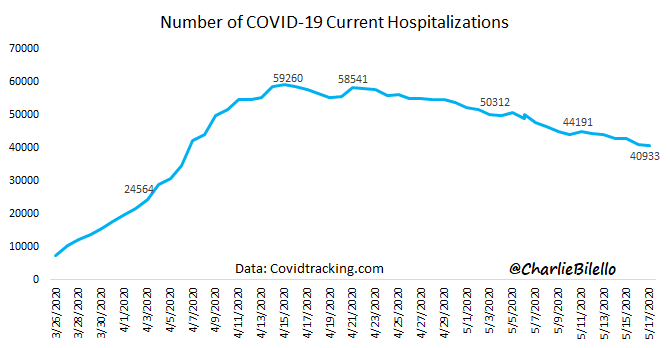

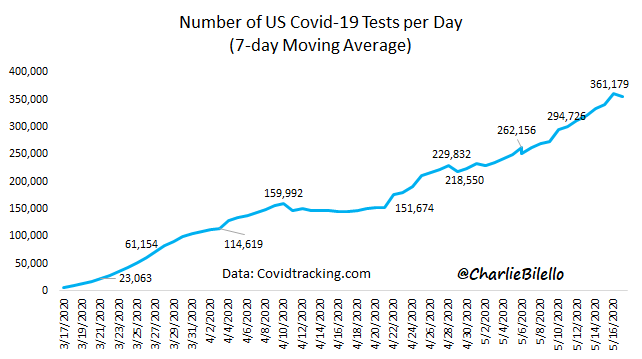

There seems to be two prevailing schools of thought right now and I won't go into the reasoning behind each in the interest of time. If you're bullish you think we're in the midst of a "V" shaped recovery. You think the economy has seen its worst and we're on the long road to recovery. You don't care about earnings right now, perhaps out several years, and you're more concerned about job metrics, numbers of hospitalizations and new Covid-19 cases than basic economic statistics. Besides interest rates are at historic lows. Bears think this is nothing but a rally in a bear market. At some point the crushing economic numbers intrude even into the stock market's bubble and a new downward cycle begins.

I lean more towards the bullish camp right now because I think we're learning to adapt to this new pandemic world. However, I also think there could be times this year when the markets hit another rough patch, especially around the elections. Based on what I've seen and what we currently understand about the virus, I think there is a higher probability that we've seen the market lows for this cycle. I'll emphasize though the "based on what we currently know" part.

The one thing I do know is if you were absolutely certain the end was nigh back in the winter when stocks cratered then you've been handed a gift given this recovery. Most major indices we track are now back to where they were in the fall of last year. If you're in that bearish frame of mind then now is the time to review your asset allocation, either with me or with somebody else.

However, if you're in that frame of mind, remember if you bet that way and sold in the spring then you so far bet against the American economy and lost. Indices, even the worst performing ones, are up double digits since March. Stocks will continue to be volatile and we all need to steel ourselves to the higher probability of some negative headline knocking some froth off of this rally. But historically betting longer-term against our economy has been a losers bet and likely will be in the future as long as we have a dynamic capitalistic system.

Just remember, nobody knows for sure.

Back early next week.

*Long ETF’s related to the S&P 500 in both client and personal accounts.