Here's my thoughts on where the market sits right now.

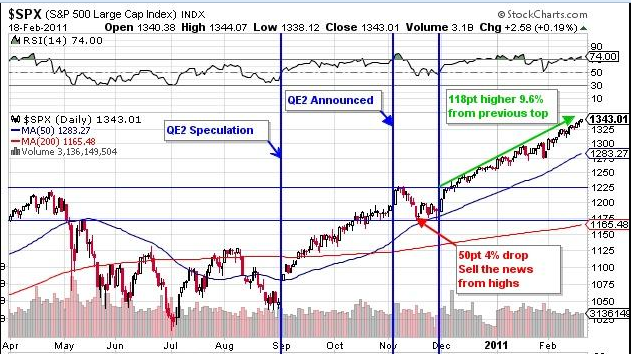

Fundamentals are mixed. For every bad statistic investors want to throw out {high unemployment, bad earnings releases, Europe, Apple etc.} others can point to statistics that show improvement {rising housing prices, rising business productivity improvement, rising tax collections, Europe, Apple etc}. Let's call this a push with economic statistics consistent with an economy growing in the 1.5-2.0% range. The Federal Reserve's new round of quantitative easing is being viewed by both investors and traders alike as a safety net at some point underneath stocks.

Longer term trends: Markets are in a bull market and have been now for almost a year. Stocks are up nearly 24% in the last twelve months. Our long term money flow analysis on stocks is NET MARKET POSITIVE. This reading has not changed for several years.

Valuation: At 1441 the S&P 500 trades at a 13.89 PE based on our 103.75 year end corporate earnings target. That is roughly a 7.2% earnings yield. The current dividend yield on the S&P 500 is about 1.9%. By comparison the US 2 year Treasury currently yields 0.266 {roughly 1/4%}. Our price valuation cone for equities remains between S&P 500 1,300-1,525. Stocks are roughly in the middle of that range.

Money flows: Stocks remain over bought in all three of the time frames we measure which was one of the reasons we moved our short and intermediate money flow analysis a notch lower back on

08.08.12 to

NET MARKET NEUTRAL. While these have pulled back a bit over the past few weeks as the market has churned around some these are still indicative of stocks that have out run their current rally. The percentage of stocks trading above both their 50 and 200 day moving averages is still elevated and still at levels that have in the past signaled some type of correction. Please remember that just because stocks are in a corrective mode does not necessarily mean they must decline much in value. Stocks can correct by price {stocks decline} by time {stocks churn and go nowhere} or by both.

Seasonal patterns: Stocks have so far outwitted the seasonal weakness that normally prevails between late August and mid-October as the S&P 500 is up a bit over 4% during that time. It is possible that the election period will bring about a bit of unevenness. However, I believe that markets are increasingly pricing in that the President will be reelected on November 6th so this may be less of a factor now than was expected a month ago.

Outliers that could change stock prices before the end of the year: Changes in the European debt crisis, new developments in the Middle East, a further deterioration in relations between Japan and China, a corporate earnings slowdown that is more dramatic than investors currently anticipate, no progress on the fiscal budgetary impasse that threatens huge spending cuts starting January 1 or any other unanticipated event that we currently cannot see.

Summation: Stocks have had a pretty impressive run since the beginning of the summer. They are now displaying all the classic signs of a market that is tired and in the least needs to rest and regroup before trying to head higher. It is an unknowable today whether that thrust to the next level comes from these levels or whether we must head a bit lower first. We have been very quiet for clients so far this month. We raised a bit of cash at the beginning of the month so that accounts in general have a position of around 10-15%. While in general we have seen no reason to change that allocation, we have had the defensive pages of the playbook and game plan open for quite some time and there are a few things we might consider taking off the table should some of our individual security indicators change for the worse in the next few weeks. Irrespective of that though stocks still have the potential to head higher in the months ahead, but it is likely that will occur after a period of digestion of the current results.

*Long ETFs related to the S&P 500 in client and personal accounts. Long shares of Apple computer for certain clients at their own discretion. Apple is a key component of several ETFs that we own both personally and for clients. Long various European ETFs in client and personal accounts.