I Have An Investment Plan Do You? {Introduction}

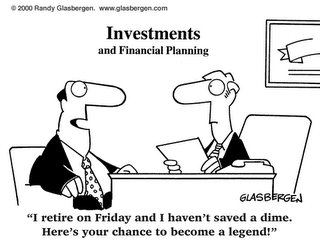

This cartoon is not an investment plan! Neither is relying on the lottery or a windfall from relatives at some point to fund your retirement, your children's college or that vacation home you've always dreamed about.

This cartoon is not an investment plan! Neither is relying on the lottery or a windfall from relatives at some point to fund your retirement, your children's college or that vacation home you've always dreamed about. If tomorrow I had to turn my personal money over to somebody else to invest I would after an initial vetting process arrange to meet a select few advisors. I'm assuming that I would sit through a presentation of their investment style and/or investment process. Then I would then ask them one question. "What is your plan for managing my money." By this I would mean what are your plans for my assets in both good times and bad? Do you have bull market & bear market strategies? How will you protect my money? I think that most advisors once they made it past the asset allocation process would be hard pressed to answer any of the three questions posed above. Much is made in the financial media about asset allocation. It is an important part of the investment process but it is the beginning not the end of the process.

I'm going to begin a series on what I've learned in almost 20 years investing money for myself and for clients. My hope is to do one piece of this each month. In these articles I will lay out how I formulate the investment process that I use at Lumen Capital Management and then how I translate that process to a portfolio investment plan. This point of having an investment plan I believe is the most important weapon that I can bring to the table in the war for investment survival. Because I have an investment plan for all of my clients which is based on what I know of their investment goals, what I know of how much risk they are willing to take at any given point and what I know of where they are at a certain point in their lives.

<< Home