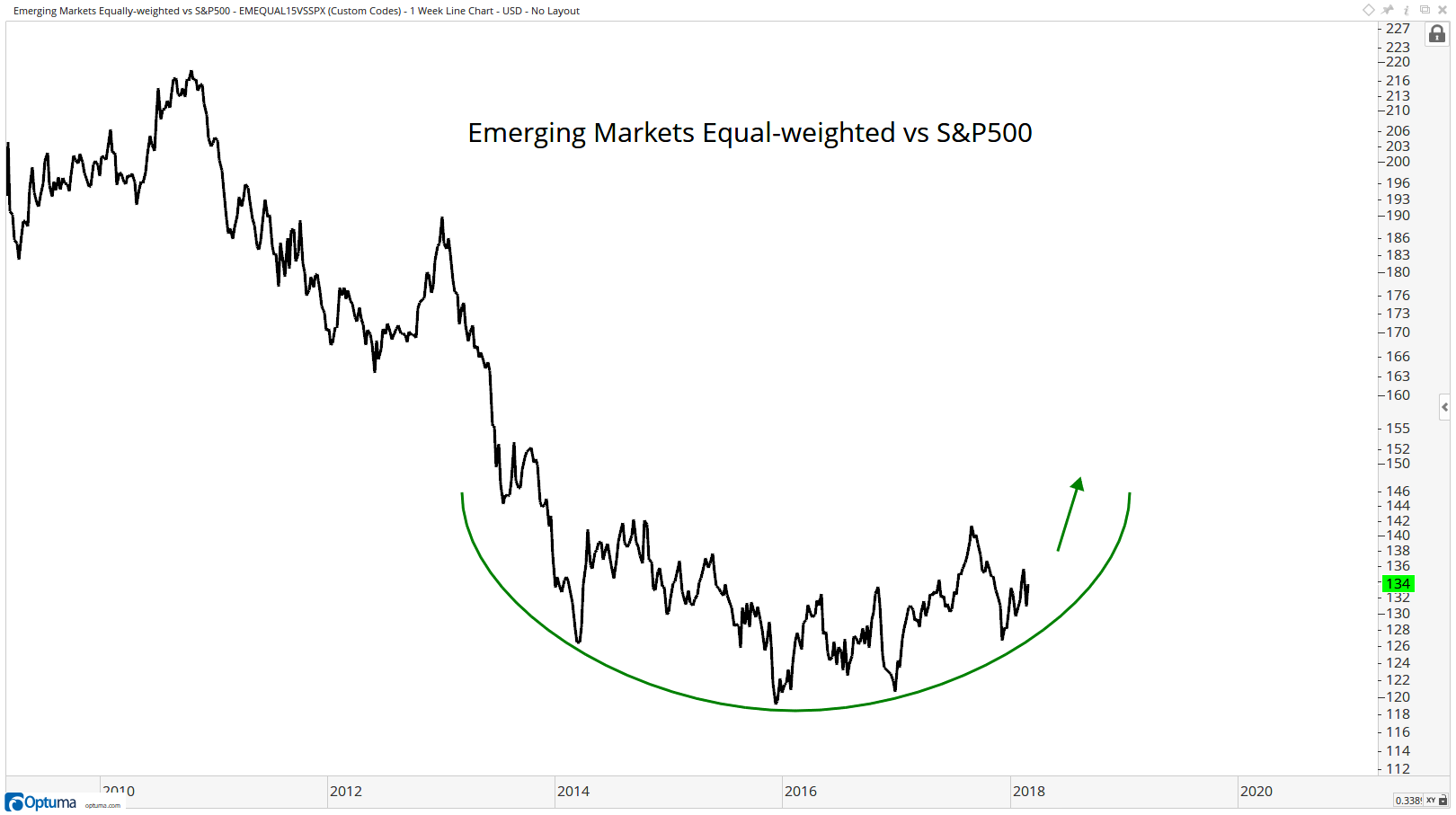

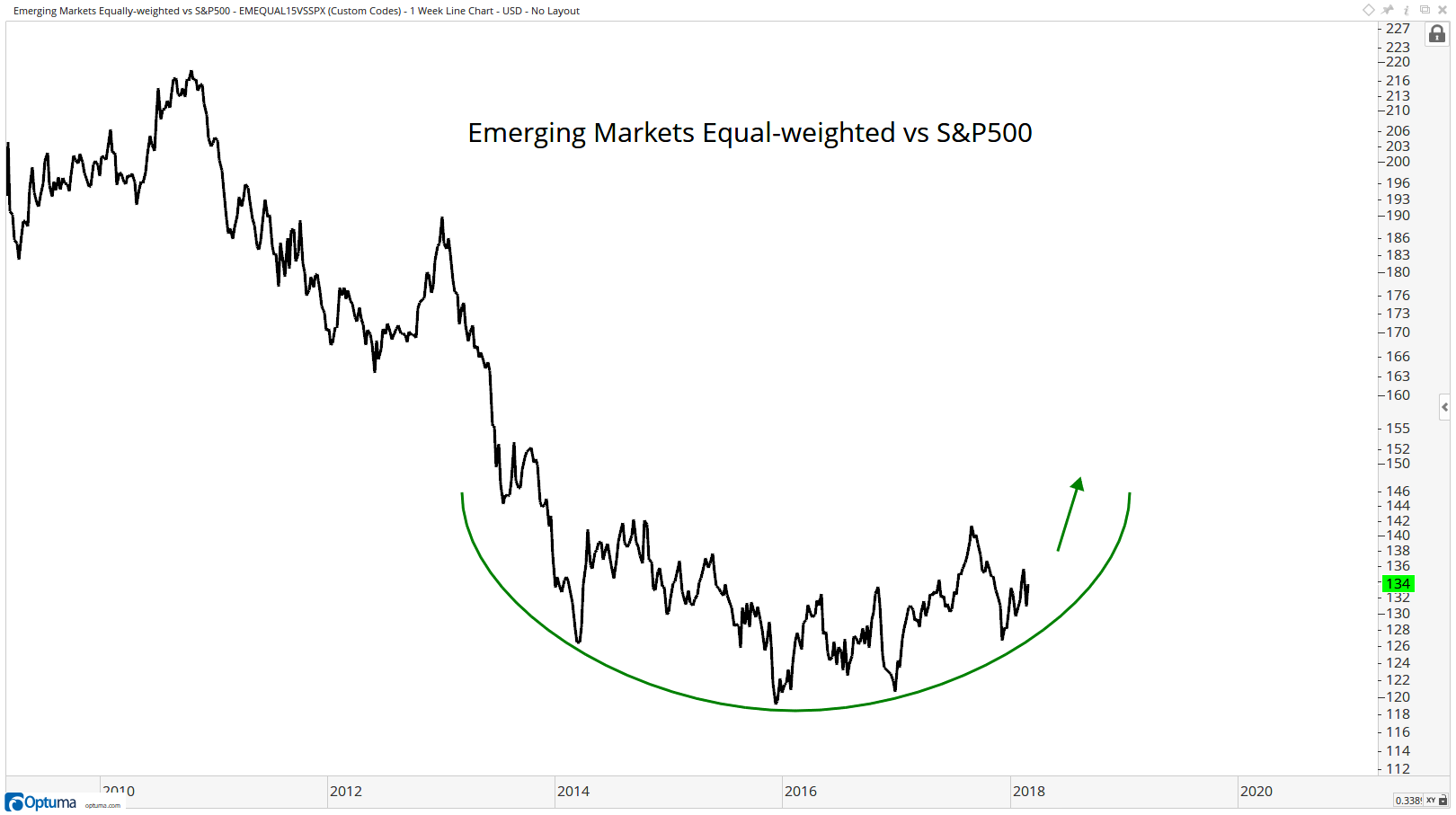

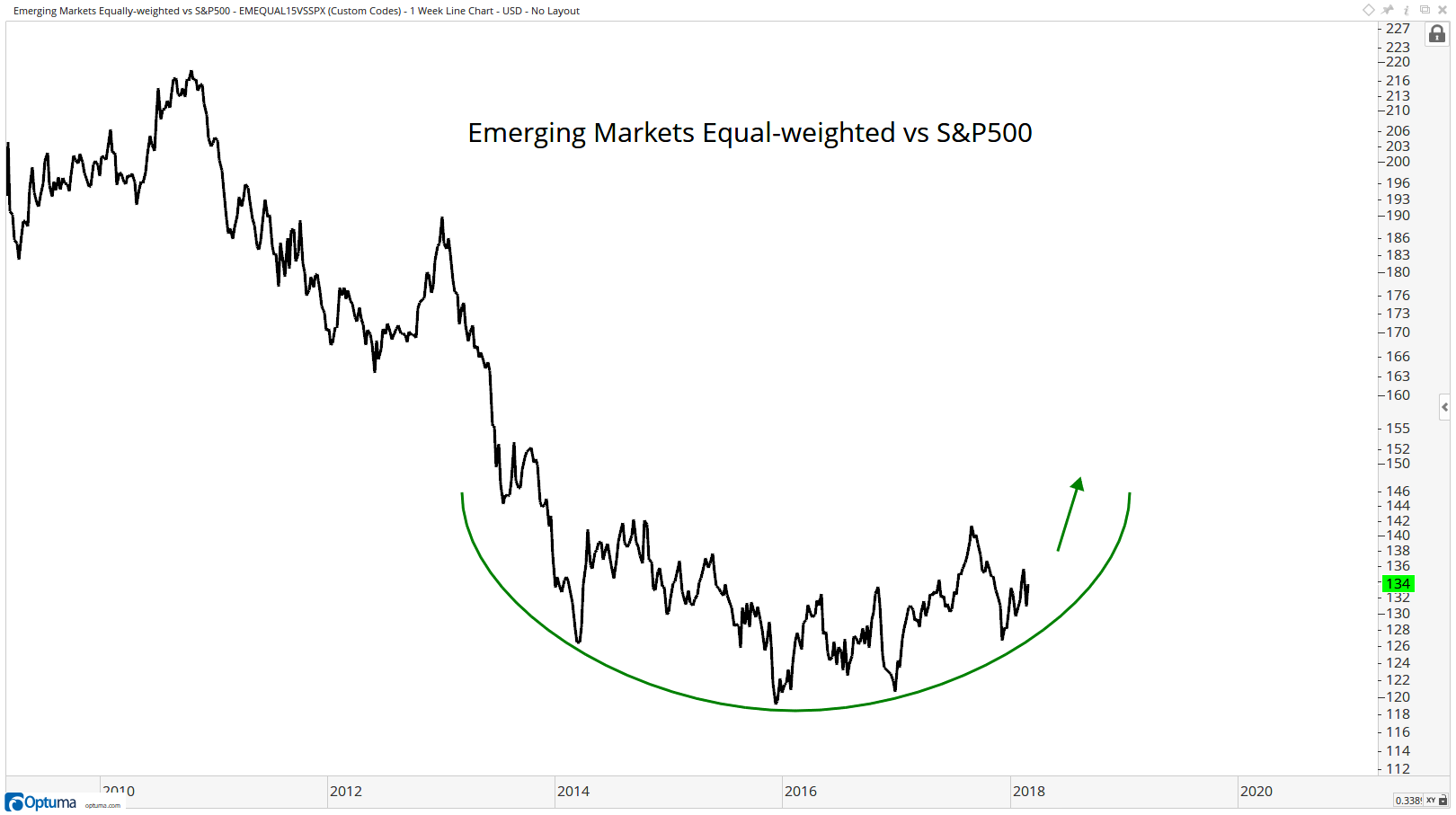

Markets have been choppy of late and that has also hit foreign markets. This has also applied to emerging markets which also saw double-digit declines early this month. However as noted at both the blogs "Abnormal Returns" and "All Star Charts", emerging market have seen their relative underperformance versus the S&P 500 end in early 2016. Emerging markets and foreign investing badly trailed the US in the last decade so it wouldn't be a surprise to see interest in these areas of the world pick up, especially if this synchronized worldwide growth we've seen over the last year continues into 2018. Perhaps it's time for foreign stocks to take on the mantle of market leaders? Something to keep on your radar as the year unfolds.

Back later this week.

Long ETFs related to emerging markets and to the S&P 500 in client and personal accounts. Short S&P 500 in a personal account as part of a separate individual strategy.

<< Home